In the March 2021 edition of Numera’s Global Macro Monitor, we discuss China’s economic outlook and the factors behind the ongoing CN equity sell-off. We find that the correction realigns stocks with macro fundamentals, which in a context of strong global growth limits tail risk on new investments.

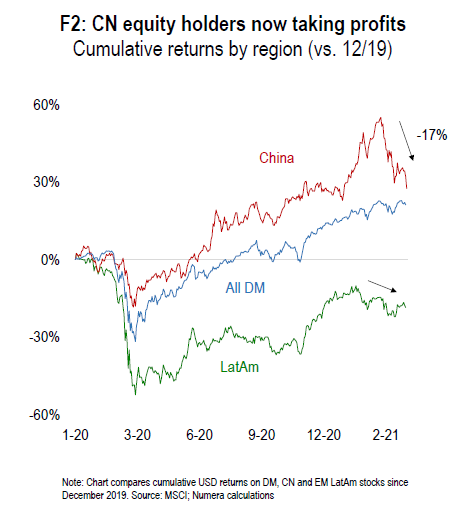

Rising US Treasury yields have caused a reversal in EM institutional flows since mid-February, depressing EM assets after four months of strong returns. CN stocks are undergoing a particularly steep correction, as high valuations and fears over PBOC tightening have encouraged investors to take in profits after a remarkable ‘bull’ run.

In this month’s report, we discuss the outlook for China’s economy and CN equities. We find that CN GDP should continue to outperform, boosting expected returns for 2021. However, the likelihood of double-digit returns has declined sharply versus last year.

Please note that starting this month we are adding 24 new concepts to the Investment Recommendations table of the report. The expanded equity coverage corresponds to 94% of worldwide market capitalization. Numera clients have access to the underlying probability forecasts via our Macro website.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.