The October 2020 edition of Numera’s US Macro Monitor focuses on the short and medium-term impact of a ‘second wave’ and of a potential stimulus bill. We first discuss how both developments affect the growth outlook, and then explore implications for equity returns and asset allocation.

Stocks plunged yesterday on fears of a disruptive second wave. As we point out in our latest US Investment Views, rising infection rates, gridlock in Congress and the possibility of a contested election all fuel volatility.

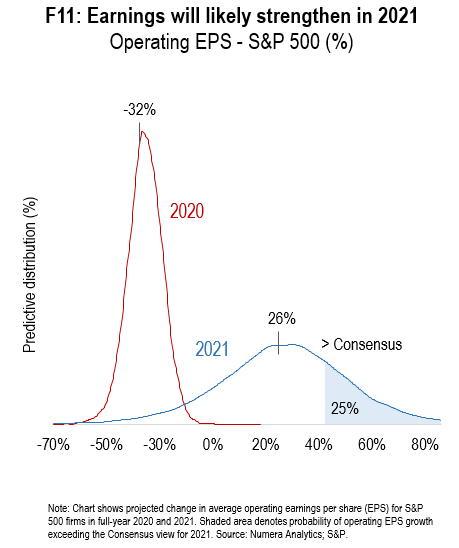

In this month’s report, we discuss the implications of these factors for equity strategy. While a more prudent stance is justified on 1-3M investments, 12M holdings retain a favourable risk-reward balance. The higher upside reflects continued Fed stimulus and strong earnings prospects:

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.