No region has been as disrupted by COVID-19 as Latin America. The virus has weighted heavily on growth and equity prices, but shifting public health prospects may revert the current trend. In this special report, we discuss our latest views on LatAm equity investments. We find there is a strong case for overweight positions on 12M holdings.

LatAm stocks have fared poorly against other regions over the past six months, weighed down by steep declines in economic activity, weak currencies and an unfavourable sectoral composition. In this special report, we examine the attractiveness of new investments in LatAm stocks amid shifting public health prospects. We first discuss the region’s growth outlook, and then evaluate the risk-reward balance of LatAm stocks and the five largest markets in the region.

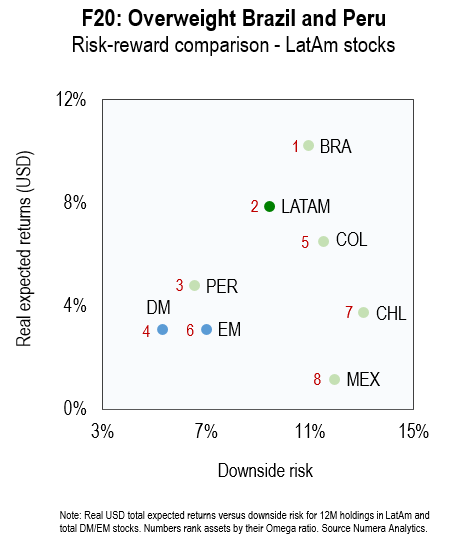

We find there is a strong case for increasing equity exposure in Latin America, although we recommend a targeted geographical approach given a varying sensitivity to global macro shocks:

Contact Chris Cook at ccook@numeraanalytics.com to access the full special report.