The first edition of Numera’s LatAm Macro Strategist offers a deep dive on key macro themes affecting the regional investment outlook.

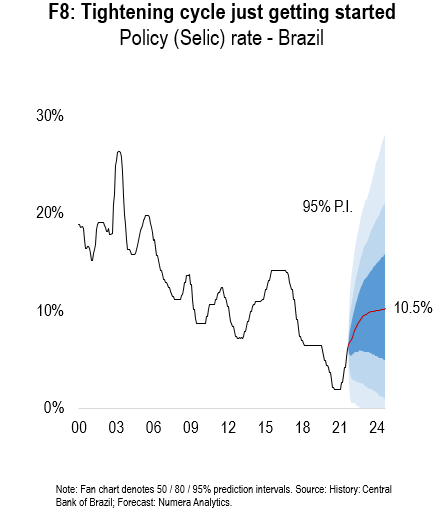

In this first edition of the LatAm Macro Strategist, we analyze the implications of the abrupt hawkish turn taken by Latin American central bankers. Our modeling work points to elevated inflationary risks over the next two years, translating into a more hawkish interest rate outlook than currently anticipated by market participants. For example, we expect the BCB’s benchmark Selic rate to exceed 10% by H2/22, well above market expectations.

From a strategy standpoint, we expect these tighter monetary conditions to contain long-term inflation expectations, limiting the pass-through of policy hikes to long-term yields. The resulting flattening of LatAm sovereign yield curves therefore improves the relative appeal of long-dated bonds. Our equity models, in turn, suggest investors should be overweighting Mexico while reducing their exposure to Chile and Peru.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.