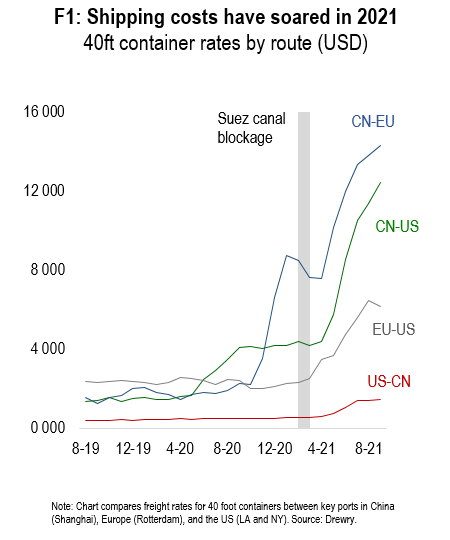

The September 2021 edition of Numera’s Global Macro Strategist (renamed from Global Macro Monitor) analyzes the investment implications of ongoing supply chain disruptions. Elevated shipping costs and delays in delivery weigh on the global investment outlook, since they weaken growth and amplify inflationary pressures.

Strong demand for goods, tight shipping supply and labour shortages have caused global transportation costs to soar, while creating severe backlogs at ports, rail networks and warehouses. Delays in delivery make it difficult for producers to expand production, causing inventories to plummet and amplifying inflationary pressures.

In this month’s report, we explore the consequences of these disruptions for the global economic and investment outlook. For global asset allocators, the key implication is that logistical challenges worsen the relative appeal of nominal bonds as a macro hedge. In the final section of the report, we also discuss the potential spillover effects of the China Evergrande crisis.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.