The January 2021 edition of Numera’s US Macro Monitor explores the growth and equity market implications of President Biden’s $1.9T stimulus proposal. We find the full package could lift real GDP by about 3.5% this year and operating earnings by as much as 15%.

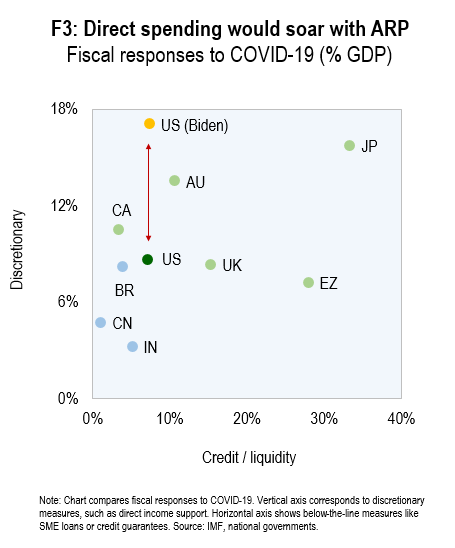

President Biden’s $1.9T stimulus proposal has major economic and financial market implications. If approved, the package would push the government’s overall fiscal response to a staggering 27% of GDP, with a higher amount allocated to discretionary policies (e.g. direct income support) than any other major economy:

In this month’s edition, we evaluate the impact of the policy proposal on GDP growth and equity returns. We find that the full package would eliminate all remaining output losses while pushing profits well above their pre-COVID path. Most of the support would stem from policies aimed at combating the pandemic, with stimulus checks playing a much more limited role.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.