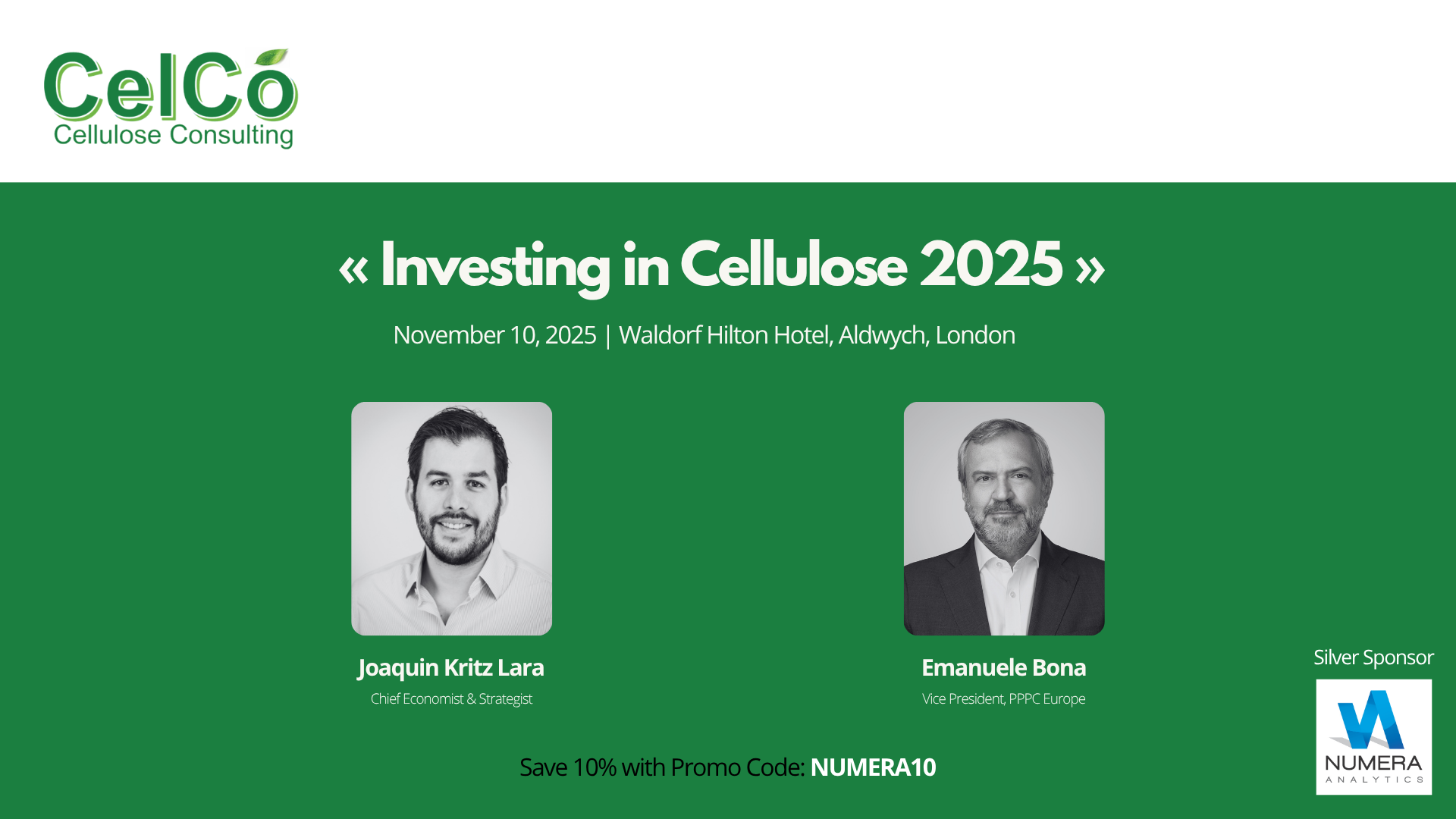

Numera Analytics is proud to be a Silver Sponsor of the “Investing in Cellulose 2025” Conference, set for November 10, 2025, at the Waldorf Hilton Hotel, Aldwych, London. Our experts Joaquin Kritz Lara and Emanuele Bona will share key insights on the Global Economic Outlook and Tariffs, and the Latest Developments in the Paper Pulp Industry.

Save 10% on your registration with the promo code: NUMERA10