The February 2021 edition of Numera’s US Macro Monitor explores the possibility of ‘overheating’. While GDP should normalize by Q4/21, it will take longer for the job market to recover, mitigating inflationary pressures. The macro outlook favours stocks over bonds, especially ‘reopening’ sectors.

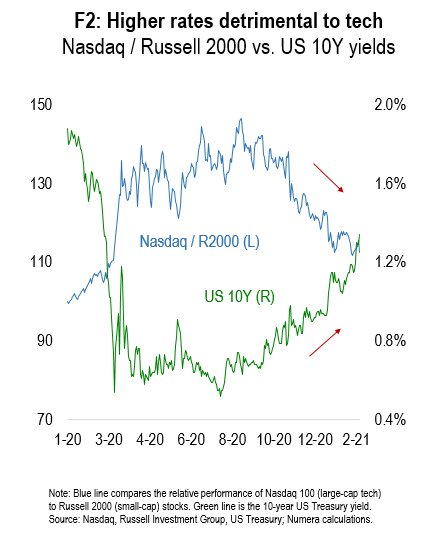

A rapid vaccine rollout and expectations of further fiscal stimulus have sparked a heated debate on whether the US economy will overheat (exceed potential). Expectations of stronger growth and inflation are the key factors behind a steep rise in long-term yields over the past month, accelerating the rotation away from tech stocks:

In this month’s report, we discuss whether the economy will in fact hit capacity constraints, and how this would affect inflationary pressures. Please note that Numera clients can download all the charts via our internal Macro website.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.