The April 2021 edition of our Commodity Market Outlook focuses on base metals and iron ore, covering recent market developments and our pricing outlook over the coming year. As usual, we also provide an update on our latest views on broad commodity markets.

This month’s edition focuses on industrial metals, among the strongest performing assets during the COVID-19 pandemic. We offer a ‘deep dive’ on base metals and iron ore, analyzing both the impact of economy-wide and industry-specific shocks on current and future market dynamics.

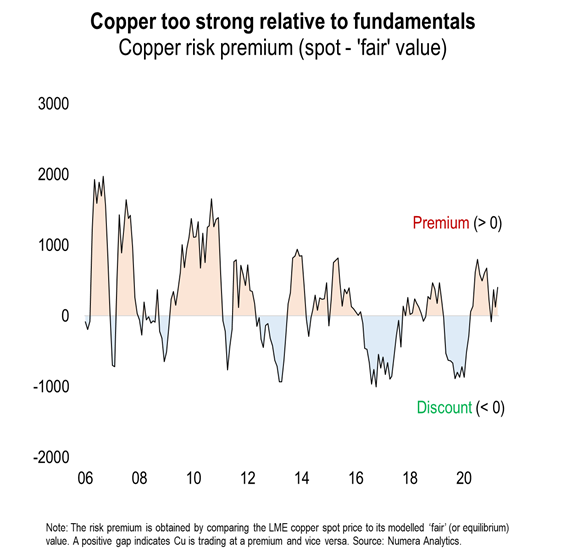

Industrial metals continue to trade at very high levels, fueled by strong cyclical conditions in China, strong residential construction, a swift recovery in private sector investment. Nevertheless, bullish trader sentiment since late 2020 has pushed both the prices of copper and iron ore well above the level supported by fundamentals:

In this month’s report, we explore the likelihood of an industrial metal ‘super-cycle’. Despite strong global growth, we expect both copper and iron ore to weaken over the coming year. The copper outlook, however, remains favourable at longer horizons in part owing to the adoption of green energy technologies.

If you would like more information, please contact Chris Cook at ccook@numeraanalytics.com.