The October 2021 edition of Numera’s US Macro Stategist discusses the investment implications of a probable shift from reflation to overheating. We find strong evidence the economy could overheat in 2022, favouring value over growth and worsening the appeal of sovereign bonds as a macro hedge.

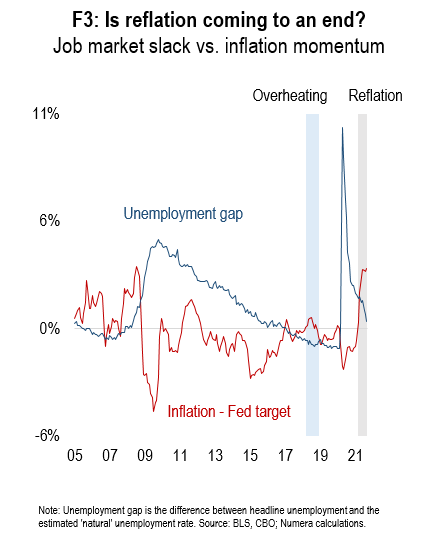

The US economy shifted to a ‘reflationary’ macro regime in Q1/21, in which strong growth and falling unemployment coincide with elevated inflation. Reflation trades have outperformed this year, but our analysis reveals the economy could soon shift from reflation to overheating – a less favourable regime to both stocks and bonds:

In this month’s report, we discuss the factors that could cause this regime shift, and how to structure stock-bond and equity-only portfolio to maximize upside risk and minimize potential losses in this environment. To download all the charts, please contact Hayley Reid at hreid@numeraanalytics.com..