The November 2021 edition of Numera’s Global Macro Strategist explores the case for an increased EM exposure in global portfolios in 2022. Although EM assets are trading at a discount, we find global and domestic macro forces weaken the relative appeal of most EM investments.

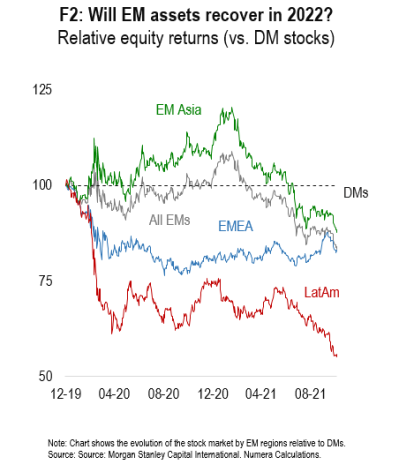

Emerging market stocks and bonds have vastly underperformed this year, despite a ‘reflationary’ global macro regime. EM stocks, in particular, are trading at very low earnings multiples, which raises the question of whether global investors should increase their exposure to Asia, EMEA or Latin America in 2022:

Our modeling work suggests that contractionary macro policy, a narrower growth ‘premium’ with EMs, and Fed tapering weaken the risk-reward balance of EM assets over a 12M holding period. One notable exception are hard currency bonds, not directly exposed to FX risk are less sensitive to high inflation and monetary tightening.

As usual, Numera clients will be able to download all underlying charts through our internal macro website. If you are interested in a tour of the website, please contact Hayley Reid at hreid@numeraanalytics.com.