The November 2020 edition of Numera’s Global Macro Monitor focuses on equity market prospects for Europe in a context of rapidly worsening public health outcomes. Although favourable vaccine developments boost the medium-term outlook, high stock prices and a probable near-term downturn worsen the appeal of new equity investments.

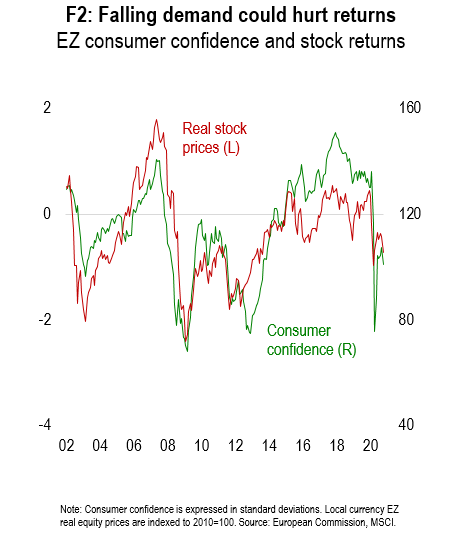

Critical cases in Europe have risen sharply over the past month, weighing heavily on contact services. Mobility trends point to a 6%+ contraction in EZ GDP in Q4, which could weigh heavily on consumer and business sentiment, and by extension on equity returns:

Short-term (1-3M) investments face a high probability of negative returns, while the upside on 12M holdings is no longer high enough to justify overweight or even neutral positions on EU stocks. Given strong projected growth in 2021, a 10-20% correction would materially improve the appeal of new equity investments.

Short-term (1-3M) investments face a high probability of negative returns, while the upside on 12M holdings is no longer high enough to justify overweight or even neutral positions on EU stocks. Given strong projected growth in 2021, a 10-20% correction would materially improve the appeal of new equity investments.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.