The July 2020 edition of our Global Macro Monitor focuses on the European economy. We first discuss our latest economic outlook for the region, given ongoing mobility trends. We then turn to European equities, which we have now upgraded to overweight on growth, FX, and valuation considerations.

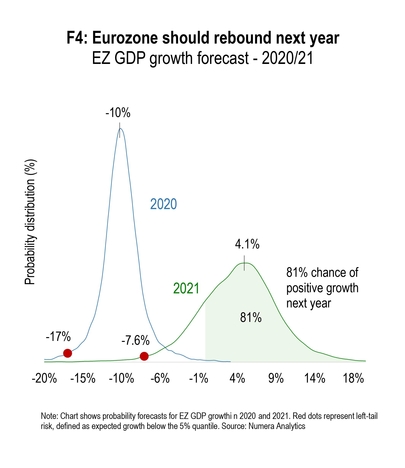

While much of the world struggles with new COVID outbreaks, Europe is now in recovery mode. High frequency indicators point towards a sizeable improvement in activity in June, particularly in northern Eurozone countries. In the first section of the report, we explore the implications of improved mobility for EZ growth prospects.

Stronger demand plays a key role in shaping the risk-reward profile of European equities. Despite deep economic losses in the first half of the year, European stocks now exhibit a better risk-reward balance than most other risky assets, including US stocks:

The strategy section of the report discusses the various factors shaping the European equity outlook. We evaluate risks and opportunities for total European equities and the most important markets in the region.

As usual, we also provide updated investment views and projections for all major global asset classes.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.