The July 2020 edition of our US Macro Monitor focuses on the factors weighing on household spending, by far the biggest drag to activity today. We examine the disrupted link between income and consumption and evaluate the role of behavioural factors. We then discuss the implications of consumption shifts for US investment strategy.

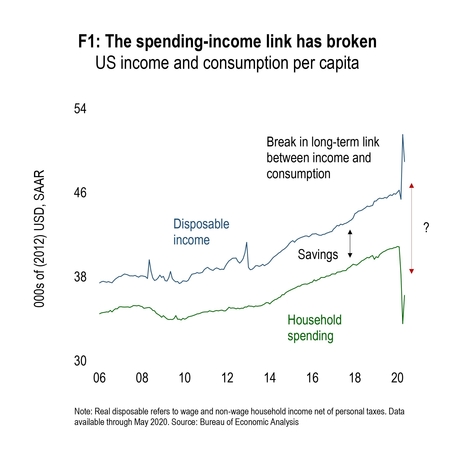

One striking feature of the COVID-19 recession is the break in the long-term link between income and consumption. While disposable income has risen markedly on emergency stimulus, consumption remains well below its pre-crisis level:

While it may appear that macro policy has done little to prop up demand, we find stimulus has been very effective in propping up demand for sectors that do not directly pose health risks. Crucially, the combination of higher-income / liquidity and restricted consumption also helps explain the outperformance of tech (including e-commerce and digital media) versus the broader stock market.

In the investment strategy section, we discuss the implications of ongoing consumption shifts for equity market prospects, and for asset allocation decisions.

For a full understanding of our research platform and to obtain a complimentary trial please contact Chris Cook at ccook@numeraanalytics.com.