The resurgence of trade tensions between the United States and China has far-reaching implications for the world economy. One major topic of debate is the impact of tariffs on US inflation, and whether the Trade War could alter the Fed’s chosen course of action. In this short research note, we explore the impact of the new round of tariffs on US PCE and PPI inflation. This is the second of a four-part focus on the US, China and Trade war implications.

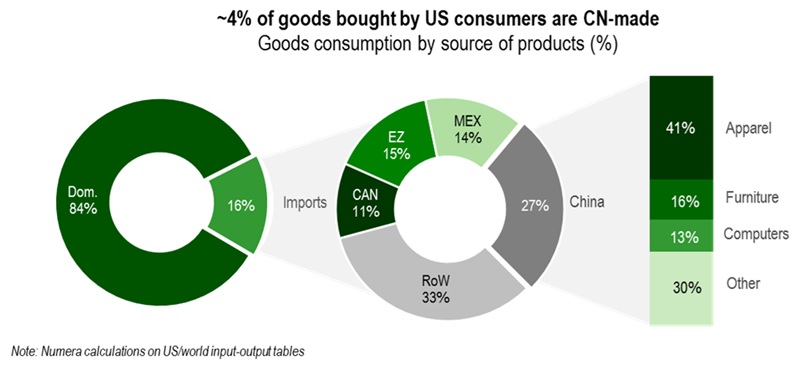

Just how much tariffs on Chinese imports affect US inflation depends on how much Americans rely on these products. As shown in the chart below, about 16% of the $4 trillion+ US consumers spend on goods annually are met by imports. The share is much higher than for total household purchases since services are largely supplied domestically. Thus, while tariffs may have a limited impact on headline inflation, they could have a noticeable effect on the cost of goods for specific categories. As can be seen in the second panel, China is the leading supplier of consumer goods to the United States, doubling Mexico’s market share. Apparel and computers make up for over half these imports, reflecting China’s role as the world’s leading producer of clothing and consumer electronics.

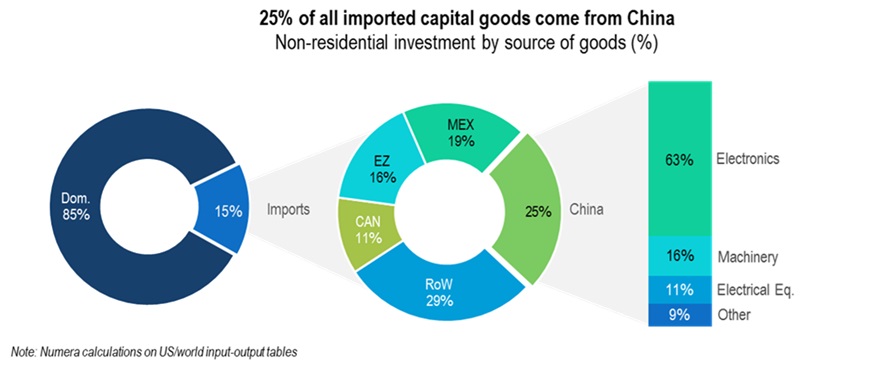

Yet tariffs create pricing pressures beyond their direct impact on consumer goods. In particular, duties increase costs for US businesses that depend on imports of components and/or capital equipment. Second-round effects may accentuate the initial response, with rising costs being passed-on to producers with a limited direct exposure. Consider the contribution of imports to non-residential private investment (capital spending on machinery, structures and equipment) below. US companies again rely heavily on imports of capital goods, with China accounting for 25% of the imported share.

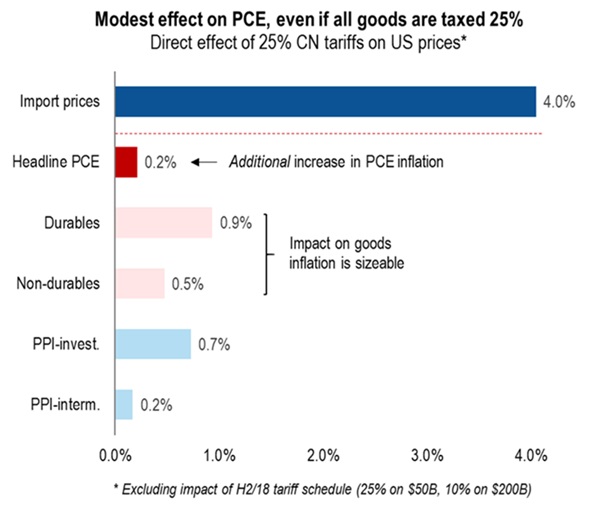

With a clear idea of the contribution of Chinese imports to US expenditures, we can then compute the inflationary effects of this new round of tariffs. In principle, higher duties may be offset by a decline in the prices charged by exporters, but recent academic evidence finds strong evidence of a full pass-through. Assuming a proportional increase in duty-inclusive prices, the chart below shows the direct impact of a 25% tariff on all imports from China on PCE and PPI inflation. Importantly, the calculations exclude the portion of the tariff schedule already implemented as of April this year. Levying a 25% tariff rate on all products from China would cause headline PCE to increase an additional 0.2%. Goods inflation, however, would increase markedly, with the price of durable goods rising close to 1%. Similarly, capital goods inflation would rise ~0.7%.

Of course, the above calculations entirely ignore macroeconomic dynamics. Rising import prices may prompt substitution towards locally-produced goods, helping US firms increase price mark-ups. Rising input costs may further accentuate inflationary pressures unless producers fully absorb the tariff cost (hurting profits). The expectation of an improved trade balance may also cause the dollar to appreciate in value, mitigating these initial price effects. In addition, rising policy uncertainty may weigh heavily on demand, potentially reversing any inflationary effects. Our upcoming US Macro Strategy report will analyze these and various other transmission channels, including the impact of tariffs on growth, monetary policy and asset returns.

Of course, the above calculations entirely ignore macroeconomic dynamics. Rising import prices may prompt substitution towards locally-produced goods, helping US firms increase price mark-ups. Rising input costs may further accentuate inflationary pressures unless producers fully absorb the tariff cost (hurting profits). The expectation of an improved trade balance may also cause the dollar to appreciate in value, mitigating these initial price effects. In addition, rising policy uncertainty may weigh heavily on demand, potentially reversing any inflationary effects. Our upcoming US Macro Strategy report will analyze these and various other transmission channels, including the impact of tariffs on growth, monetary policy and asset returns.