The March 2021 edition of our Commodity Market Outlook focuses on gold, covering recent market developments and our pricing outlook over the coming year. As usual, we also provide an update on our latest views on broad commodity markets.

This month’s edition focuses on gold prices, down $360 over the past six months as vaccine optimism has reduced demand for ‘safe haven’ assets. We offer a ‘deep dive’ on the factors behind the recent price weakness, analyzing the impact of macroeconomic and financial shocks on current and future market dynamics.

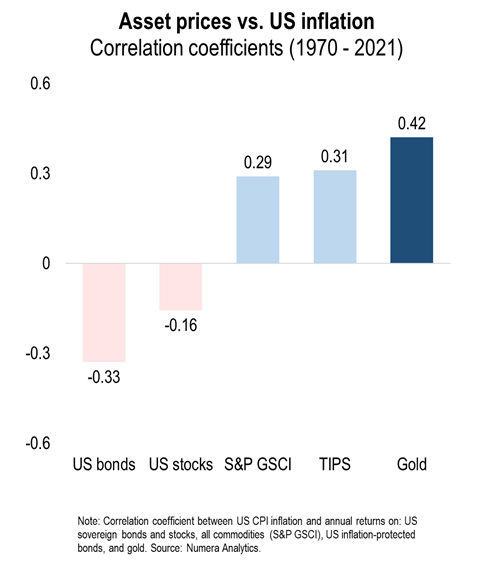

We find that investors are currently too pessimistic on gold prospects. While strong global growth and expansionary macro policy favour stocks over gold, bullion remains an attractive macro hedge given its strong link with inflation.

If you would like more information, please contact Chris Cook at ccook@numeraanalytics.com.